Fundamental Analysis involves examining economic and financial factors.

Here are some aspects you need to understand about the company you wish to invest in:

- Stock Screening: Important factors to consider when selecting a suitable stock for investment.

- Company Structure: Understanding the company’s organizational setup.

- Competitors: Identifying the company’s competitors.

- Intrinsic Value of Stock: Determining the true value of the company’s stock.

- Reading Financial Statements: Analyzing the company’s financial statements.

- Future Opportunities: Analyzing future financial reports.

Key Factors for Analysis:

A) Financial Factors: (Financial Report)

B) Economic Factors: (Economic Report)

Considerations:

- Profit and Loss Statements

- Revenue

- Operations

- Debts

- Cash Reserves

- Competencies

Fundamental Analysis involves understanding the following aspects:

- Liquidity

- Profitability

- Price of the Stock

- Leverage

Liquidity:

The term liquidity refers to how quickly and easily a stock can be bought or sold in the market. It indicates the ease with which a stock can be converted into cash without significantly impacting its market price. Cash is considered the most liquid asset.

At the same time, stable stocks are less liquid . (buy/sell tradinding (Liquidity)

Two types of Ratio:

- Current Ratio

- Quick Ratio

Current ratio:

=Current Assets/Current Liabilities

Quick Ratio:

=Current Assets-Inventory / Current Liabilities

Good Range for selection= >1 (Greaterthan1)

Good Selection Range more than 1 %.

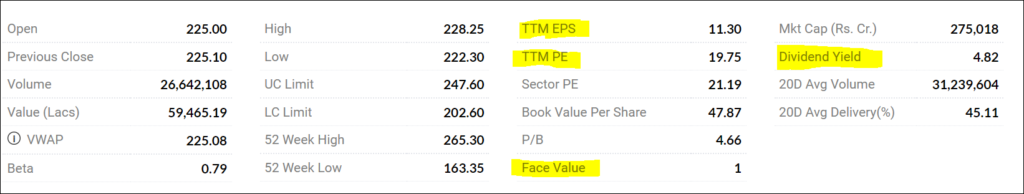

EPS (Earnings Per Share):

Earnings Per Share (EPS) is a statistic that describes the profit allocated to each outstanding share of a company. It is calculated on a quarterly or annual basis. EPS is determined by dividing a company’s net income for the period by the number of outstanding shares.

EPS serves as a fundamental measure of a company’s profitability and helps investors gauge whether a company is a good investment.

EPS = Net Income for the Period / Number of Outstanding Equity Shares

For example:

EPS = 200 Crores / 5 Crores

EPS = Rs. 40

TTM PE (Price to Earnings):

The Price-to-Earnings (P/E) ratio links a company’s stock price to its earnings per share. A high P/E ratio may indicate that a company’s stock is overvalued or that investors expect high growth rates in the future.

P/E Ratio = Current Market Price of a Share / Earnings per Share

The market average P/E ratio currently ranges from 20 to 25.

Leverage:

Leverage involves using borrowed funds to increase the potential return on an investment. It is a strategy that amplifies the effect of debt on the company’s operations.

Leverage is measured by the Debt-to-Equity Ratio:

Debt-to-Equity Ratio = Debt / Equity

Good Selection Range = <1 (Less than 1)

Profitability:

- Return on Equity (ROE): ROE measures how effectively a company uses shareholders’ equity to generate profit. ROE = Net Income (Annual) / Shareholders’ Equity Good Selection Range = 15% to 20%

- Return on Assets (ROA): ROA indicates how efficiently a company uses its assets to generate operating income. ROA = Operating Income / Total Assets Good Selection Range = More than 5%

- EBITDA: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s overall financial performance. EBITDA = Net Income + Taxes + Interest Expenses + Depreciation & Amortization A good selection range for EBITDA should be increasing annually.

- Dividend Yield: Dividend Yield measures the return on investment based on dividends received. Dividend Yield = Dividend per Share / Stock Price