I am going to clear all your basics after this, so there would not be any confusion daily, I would like to explore the questions like here what stock markets can I invest your trade in stock markets without having knowledge about it can I create income how the prices move here.

I am not that smart can I invest in stock markets hers can I make a career in stock markets I get it because at this stage you might be very confused which is completely alright now there are two possibilities first either you are still studying or you’re in college right now as a student you have got the motivation of stock market from somewhere from maybe your friend or a book or a video now you have decided.

I want to explore stock markets but you don’t know where to start on the other hand you are someone who is in a job who goes to the office you know it for a fact that investments and saving are mandatory for you, but you don’t know where to invest there are too many options available.

What do we start doing we start investing randomly at random places on other people’s advice which gets us nowhere so after reading this session after putting these minutes with me trust me all those doubts in your head will be crystal clear so your knowledge will be more than 70 of the Indian retail investors in our country.

Now moving forward let me just tell you the entire structure of the session first we are going to take it what is the stock market, second, we are going to understand how the prices move third NIFTY, BSE, SEBI, SENSEX yes fourth case studies because case studies say we’ll see live examples and we’ll understand those concepts much better fifth types of investors and types of studies sixth a strategy so that you can start applying it right now and seventh and the most important an action plan.

Fundamental knowledge about Investment and strategies with examples?

“If the base is good, then the building will be well made”.

I will clear all stock market basics, after this content is read, all of your confusion will be cleared and you will find out how and where to enter.

If you had 40 years ago, in WIPRO… I know you might not have been born then, but someone in your family had invested Rs-10,000 in WIPRO shares. So today, 40 years later, it would be Rs-700 crore. I know, you might be thinking who had Rs-10,000 then? If invested Rs-1000, would be Rs-70 crore at least Rs-100 was there, which would also become Rs-7 crore.

Definitely, there are risks in the market. As there is profit, there is loss also. There are many such stocks where if you had invested Rs-700 crore, it would be Rs-10,000 now. So, this market can bring you huge profits and huge losses too.

But so, you make a small loss and gain a huge profit. I’m here for that you know right? So, now I’m going to tell you those common questions beginners can have maybe you all have them and I’m going to cover those questions. So first I’m going to tell you all the questions and also in this blog.

The first we are going to discuss is whether the share market is risky, if yes then how much?

Second, we’ll know, how much return can you make and how much expectation can you make on this market.

Third, we’ll know how much money you’ll need to start in this market. You can be a beginner or a College student; you can start with your small savings.

The fourth process, is entering easy or difficult? what is Demat and Trading Account? basically, how to start.

Fifth we’ll know, why this market has a bad name and why our family members and films make us fear it what are those reasons, is this market really dangerous? Should you stay away from it

Sixth we’ll know, and this is a common question you are not of commerce background, you can be of engineering or arts background. Still, can you enter this market?

Seventh, how does this market work? Why do share prices go up and down? On what basis you can select your share?

Eighthly we’ll know if you need in-depth knowledge then which are those books and courses, how to make a carrier out of it?

Which blogs and magazines should you read? Basically, how can you complete your learning, we will discuss this at the end of this article.

The first question is, is the share market risky?

Basically, when you buy a share, you buy a somewhat small part of that company. That’s why it’s called share, and you become a co-owner of the company. So, if you have invested in a friend’s business and if that business doesn’t do well then, your money will drown, that is the risk. Just like that in the share market, you are investing in big companies like TATA, Reliance, and Godrej.

If the investor company drowns in the market, then your money will also drown. If the company shows very good growth, then your money will also grow. It’s just like you invest in your family member or friend’s business in the hope, that if the business grows, I will get a part of the profit, and if it’s losses then I will take the loss, and won’t have to give any interest.

So, there are many companies that drown and make a loss. But look at Eicher Motors in the past 5-10 years, they have increased the sale of Bullet bikes many times. Like that many times, more shares have grown which means Rs-1 has grown 15x-30x times. There are many shares like this, I’ve given the example of WIPRO, TVS is an example that has grown 10x-15 times in 10 years, MRF is also an example, there are many more shares like this which give you 10x times return in 5-7 years.

Definitely, it’s risky and that’s why the returns are high we will discuss Risk Mitigation methods in this video, to lower the risk.

Then the second question is s how much return will you get?

The example is the same if you invest in a friend’s business so who knows if you invest Rs-10, in the next year you’ll get 10% profit or 20% profit or 30% profit it differs a lot and cannot be a fixed criterion. For this, there are many shares in the market that don’t grow a single rupee, instead, fall and some grow 4x to 5x times in a single year.

But it’s just about one share when you’ll enter it will not just be one or two shares you’ll invest in a portfolio of stocks, like at least 5-10 companies. Because 2-3 companies come out bad or drown still, you don’t overall lose all of your money.

That’s the reason for share market we invest in at least 10-15 companies so when you get a basket of stocks, you can believe that if you have invested correctly so 18% to 20% return in India’s high-growth economy in the long run, which is at least 5 years if you had invested and you picked good stocks then you’ll definitely get around 18% to 20% in return.

This means compare to FDs, which are trending now 5x times more, and 3x times more compare to Gold and Real estate. In fact, there are many successful investors in the world who are in low-growth economies than India where the market and companies are slowly growing there, they picked such stocks, where they get around 30% return for many years.

So, in India, if you are expecting a 30% return then it’s now wrong. But your stock picking should be good. How to find such shares that will grow and bring growth to your money?

Before that, it’s important to read this article so you clear your basic concepts.

Now, a very interesting question How much money is enough to start?

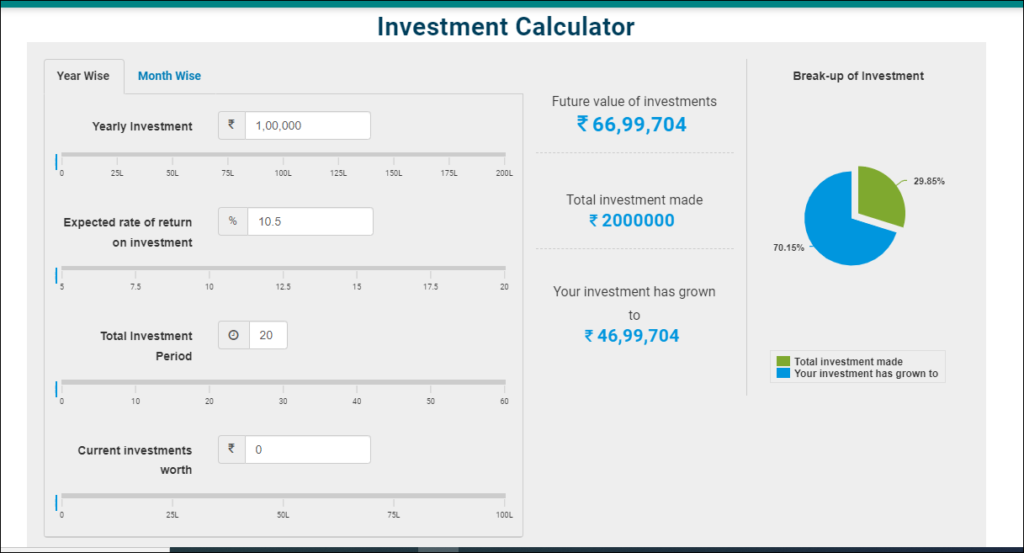

The amount of money you are investing in the stock market it’s more important than what kind of shares are you investing in and how consistently they give returns to you.

Investment Return in 20 years

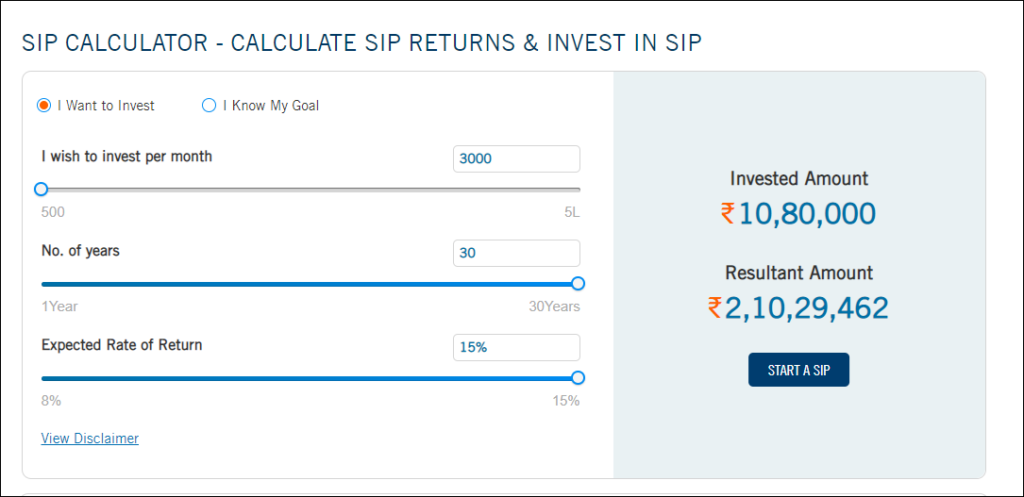

So, how did I calculate this? With the SIP(Systematic Investment Plan) Calculator, and it’s you can directly use google, and if you started with Rs-2000 or Rs-3000 so after what year how much will you make you can find out yourself.

Fourth question, how difficult or easy it is to start If I want to enter then what’s the process?

We need three mandatory documents,

Aadhar Card,

PAN Card, and

Bank Accounts are needed.

If you don’t have then open one. Nowadays, all the process is online. There are many online discount brokers discount broker is because they take almost zero brokerage.

So, you don’t need to do anything there are many online discount brokers, like Angel Broking, and Zerodha. Personally, I use Angel Broking and also open your account at Angel broking. In 4-7 days, your account will be opened online and you can start investing and trading. So, if you are buying and keeping shares and selling them after two, three days, or more then you don’t have to give any commissions. It’s almost free. Some small amount of government taxes are there which you will don’t even know because that’s very less.

The fifth question, if everything is so good then why share market’s name is so bad? Why do people fear it?

Can I tell you a simple reason this is a mindset problem?

When we buy a property, does anyone thinks in 4 days the price will be doubled and I will sell it out?

So, we give the property the time to increase we give gold the time to increase. But if your friends say you to come to the share market and they will say this too that they made Rs-50,000 in one day, doubled their money in 1 month. This means their expectations are wrong they come here thinking that, the new people who come that I just have to become rich overnight. if you play the share market as a gamble.

What is their business model? Not find out about that, and just read a chart and heard from someone and bought the shares. Then you will obviously make a loss.

So, the most important this is, that when you are coming into this market don’t think this market will make you rich overnight. Like I said, a return between 18% to 20% should be expected, if more then it’s a bonus. This means if you get an 18% to 20% return then your money will be doubled every 4 years. If we compare to Bank FD’s then in Bank FDs, it takes 11-12 years to double the money according to today’s interest rates. So, compare to that, this market offers 3x times more. Which is enough. Don’t be greedier than this.

Now you have learned engineering or arts you haven’t learned commerce then can you enter in share market?

Shall I give you the good news, yes you can?

Once upon a time in the UK, there was a survey where 12-year-old kids, and 7th-class kids. There were told to pick and basket-like 5-10 shares and at the same time Chartered Accountants were also told that you also pick and basket 8-10 shares. Where Chartered Accountants, are very educated in finance and where 12-year-old kids. But after a few years, after seeing whose shares got more returns. Then the Kids outperformed the Chartered Accountants.

In General, it’s believed that doctors are the best inventors. Why?

Are those doctors, who don’t have financial knowledge? No, It’s because they are very busy with their life’s professional life, personal life, and work from home like that. So, they don’t have time to do the number crunching and complicated financial analysis. They use general knowledge, such as what products I like, and second, as there’s no time, they invest and forget about it. They invest anything and didn’t check for 5-10 years.

Because of the transaction cost decreases and compounding amount, which I mentioned in that SIP calculator. So, if you don’t know commerce, no problem welcome to the share market. Now I am going to discuss the two most interesting parts of this video. Why do share prices go up and down every day how can you predict when prices increase, and when decreasing and why companies are listed in the share market? And second, I am going to tell you about my favorite books, and websites to learn about investing how did I learn and how can you make a career out of it. But before discussing these two topics this video deserves alike.

So, let’s find out what’s this share market concept and why prices go up and down. let me ask if you want to start a business if you need little money then family members, relatives, and friends will give you. If you need some more money, then the bank will give you. But you need Rs-20,000 crore. Now the bank won’t give you that, nor friends or relatives. Unless you form the Ambani family, which many of us aren’t. So, in this situation, who will be ready to give you this much money? The public will give you this money.

This means you will tell people your business model that this is my plan, I’m going to do this. make this factory, make this car, luxury car it will run on electricity, run on water. But I need money. Now those who trust you will give you money in return, you will get them partisanship in your company because they have put money in you so you give them partisanship in your company. That partisanship will be called Shares. You can take the money and give shares to those people.

If you are so much interested in the share market that you want to make a career out of it. So Finology’s BSE Institute certified course on value investing will be absolutely right for you. In this course, for 1 year, nonstop we will teach you investing’s all expert ways. In the end, the Bombay Stock Exchanges subsidiary which is BSE Institute will take your exam.

And if you passed, then they will give you a certificate. Which will help you a lot to make a career in this field. Now let’s discuss the last part. What are books and resources you can learn much more.

So of course, there’s our value investing course available in all languages. Apart from that, there are many books. One book is THE INTELLIGENT INVESTOR & INVESTONOMY.

Here’s everything that I have learned in the past 3 years I have put in it, you can buy it from Flipkart, Amazon, or anywhere. Other than that, what are my favorite books? RICH DAD POOR DAD is a good book for starting. After that LEARN TO EARN.

No other book Can’t tell stock market Basic, is better than this. After that little advanced level, but a very very quality book THE EDUCATION OF A VALUE INVESTOR by Guy Spier.

Read more links: https://www.elearnmarkets.com/blog/25-stock-market-terms-for-beginners/